Why Most Online Advertising Benchmarks Are BS (And What To Do Instead)

Putting your performance into perspective

No matter how good on paper it appears our online ad campaigns are performing, there is always the lingering question, “How do I stack up to the competition?” The first place most people go for an answer is Google. They will search, “Online advertising benchmarks for industry _____.” and be presented with an array of resources. However, as I often say, no data is better than bad data (since bad data leads to wrong conclusions and overconfidence), and these resources are notoriously unreliable for three main reasons:

#1 - They are not standardized based on pricing.

#2 - They are not standardized based on offer / conversion event.

#3 - Very few online advertisers properly track their data with 100% precision.

To dive into each of these points, let’s say that you find a trustworthy looking article that states, “Based on a study of 500 online advertisers, the average conversion rate for a B2B SaaS landing page in 2023 is 5%.” On the surface, this seems credible. You have a solid sample size (‘500 online advertisers’), it is industry-specific (‘B2B SaaS’), and this is fairly recent data (‘2023’).

However, as mentioned in point #1, no mention is made of how the product or service prices for these various online advertisers stack up. It should go without saying that it is going to be significantly harder to convince a buyer to shell out $10,000 per month for a product than it is to convince them to drop $50 per month for a product. But, since this data is all averaged together, you can easily come to an erroneous conclusion. More likely than not, the $50 per month product has a fairly high conversion rate (e.g. 10%), while the $10,000 per month product is far lower (e.g. less than 1%). This results in the 5% average total you are presented with, even though this middle ground is not a valid reflection of either the high or low priced conversion rates.

Next, as discussed in point #2, there is no consistency as far as offer or conversion event. Of all three reasons, this one is probably the most damning and the most difficult to rectify. Whoever gathered the data likely just asked the participants, “Can you share your landing page conversion rate?”, but they never bothered to specify, “What is being counted as a conversion?” It is common sense that some requests to landing page visitors are low lift and easy to drive action on and others are much steeper requests. A ‘conversion’ which is simply asking users to share their email and hit ‘Submit’ is not even remotely comparable to a ‘conversion’ which requires visitors to purchase a $1,000+ product. But, in the ‘8% calculation’ shared above, these are all treated equally, muddying the data beyond recognition.

Finally, as mentioned in point #3, the data that online advertisers are sharing with these surveys is more often than not incorrect. One of the hardest things for new online advertisers to comprehend is that properly tracking the conversion data for your ad campaigns requires precision and can potentially be very complex. Duplicate firing events, website changes that break tracking, firing rules that over count conversions, etc. It is not that these online advertisers are attempting to be deceptive, but rather that they may not know all the ins and outs of proper tracking or might not have a system in place to catch things when they break. Having worked with 100s of companies to craft their growth strategies, many of whom are worth millions of dollars, I would estimate over 90% of them have at least one major error in their tracking, leading to inaccurate data. This data is then fed to the companies doing these surveys on industry benchmarks, leading to confusion all around.

What To Do Instead

Before providing specific suggestions, a key point to drive home is that there are only two key online advertising metrics that matter for the sake of benchmarks:

#1 - Cost-Per-Landing-Page-Visit (for most online advertisers, this is Cost-Per-Click or CPC)

#2 - Conversion Rate

There are many other metrics that are useless at best and counterproductive at worst. For example, Click-Through-Rate (CTR) tells you nothing. Flashy and exaggerated ad copy is likely to drive a massive CTR, but very little follow-through once the visitor sees you are full of hot air. On the flip-side, targeted, direct ad copy is likely to repel those who are not a fit for your product and reel in those who are, resulting in a lower CTR but far better overall result. This also goes for me other metrics such as Time on Site (more time usually means more researching and a lack of seriousness) and Pages Per Session (same issue as Time on Site). Let’s break down the two key metrics.

Finding Reliable Benchmarks for Cost-Per-Click (CPC)

While I initially mentioned, ‘cost-per-landing-page-visit’ to include Display advertisers (who are more focused on awareness and are not as click-driven), CPC is the most crucial first metric for the vast majority of online advertising efforts. As far as how to find good benchmarks here, I have two suggestions:

#1 - Use the forecasting tools provided by each platform.

#2 - Run a series of small tests.

For #1, almost all of the online ad platforms have forecasting tools that tell you expected CPC ranges based on your selected tactics. Google Ads has their Keyword Planner (e.g. example below), which gives you the expected Top of Page bid ranges, Amazon Ads has a similar feature, and LinkedIn Ads has a ‘Suggested Bid Range’ which tells you what competitors are bidding. Since each of these suggestions are tactic specific, and since they are actually based off data from your direct competitors, these forecasts tend to be fairly accurate.

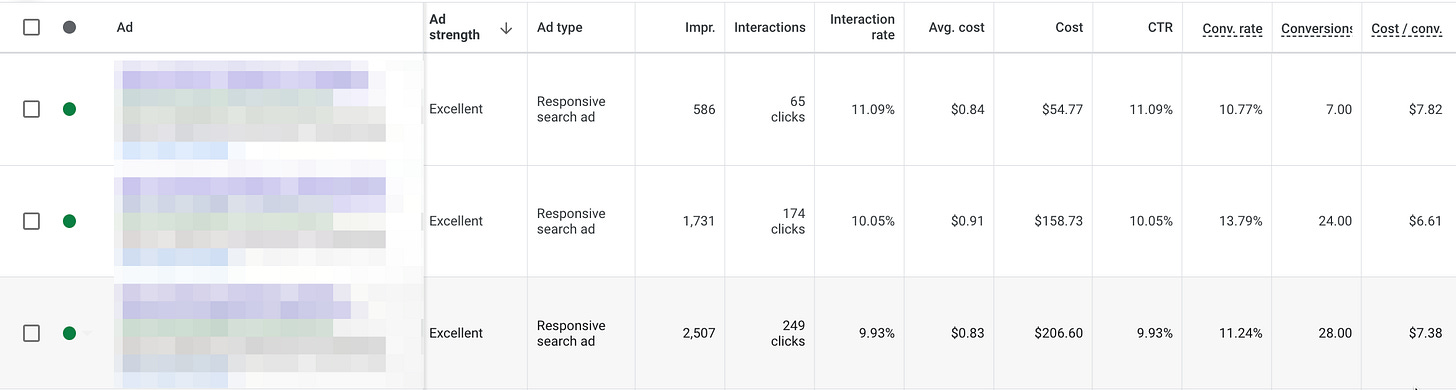

The one platform that does not have a great forecasting feature for CPCs is Meta Ads, but #2 would be my suggestion there. Simply set a small budget (e.g. $10/day) against a specific tactic and you will quickly get data back on average CPCs. It is worth noting that in order to ensure the benchmarks are accurate, it is important that you are following best practices to ensure you are on par with the competition. On Google Ads, you should make sure that your Ad Strength is ‘Excellent’ for all Ads (example below), which is fairly easy to accomplish.

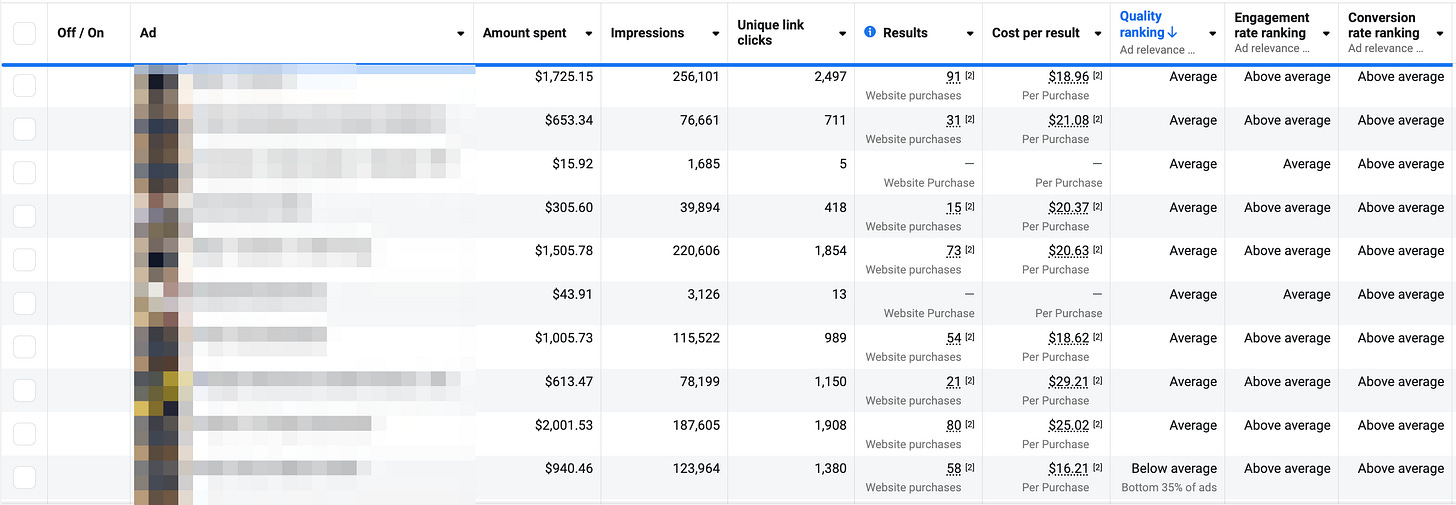

On Meta Ads, you should be aiming for Quality Ranking and Engagement Rate Ranking of at least ‘Average’, ideally ‘Above Average’ or better (example below).

At the end of the day, while forecasts have utility, nothing is going to give you better or more accurate data on CPCs then spending a few dollars and seeing what CPCs you actually hit.

Finding Reliable Benchmarks for Conversion Rate

As mentioned above, the biggest issue with attempting to benchmark your conversion rates versus the competition is that there is a lack of parity on pricing, offers, and the accuracy of data. Almost any data or research you find online is going to suffer from these problems, but I have a few suggestions:

#1 - Compare data from direct peers or competitors.

#2 - Get data from marketers or agency owners.

#3 - Use high-level estimates.

For point #1, you can join or create an organization, online group, or mastermind with individuals in your industry who are also attempting to grow their businesses through online advertising. If you are a part of a sufficiently large group, you should be able to find a critical mass of people who have similarly priced products or services and are pushing similar offers. Ideally, you are close enough to these individuals that you could also share information on your tracking setups to ensure that each individual’s data accuracy can be trusted. I would say that conversion data from 5 or more people in your industry, assuming they are all mostly following landing page best practices, should be sufficient to create some solid benchmarks on conversion rates.

Point #2 is the solution that for most people is going to be the easiest. In my career of 10+ years, I have helped 100s of clients who span almost every industry with their growth strategies. As a result, I have plenty of data, as well as a solid intuitive understanding, of what a reasonable conversion rate looks like for a specific type of product and offer. Furthermore, since I am usually the one who sets up my client’s tracking, and since this is an area I am especially strong in, the data that is captured is almost always 100% reliable. If you don’t personally know a marketer or agency owner, but want to talk to one to get industry benchmarks, here is what I would do:

1). Sign-up for UpWork.

2). Put up a job post that says, “I am looking for a marketer who specializes in industry _____”.

3). Review the list of proposals you get (it will be a lot) and set up calls with the top marketers you identify (I would suggest finding 3 - 5).

4). On the call, ask each of them “My product is priced at _____, my offer is _____. Have you ever worked with a client with a similar profile and if so, what would you expect for a typical landing page conversion rate?”

5). If they are genuinely experts with years of experience, they should easily be able to give you data-driven benchmarks based off of similar types of clients they have worked with.

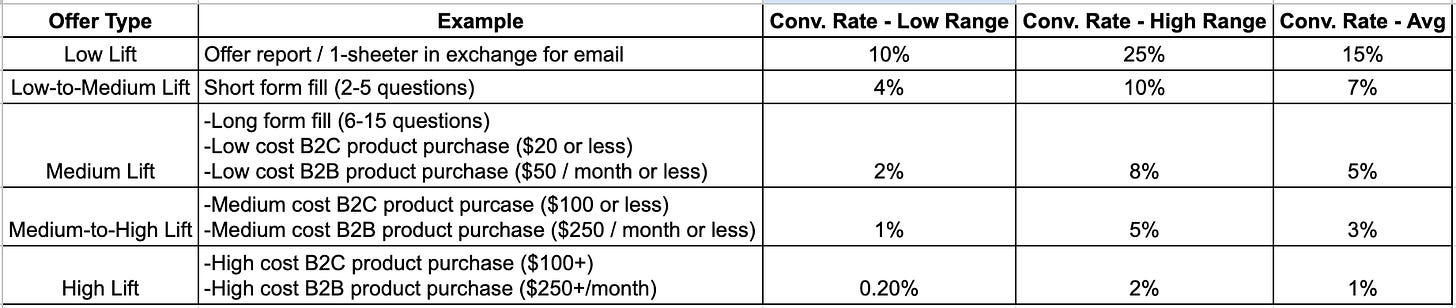

For Point #3, I am going to share some high-level benchmarks to start with. I am painting in broad strokes here and trying to find numbers that are mostly applicable to everyone, so take these with a grain of salt and also take approach #1 or #2 as well. Here are the benchmarks, categorized by the type of offer you have on your landing page (product / service price only comes into play on the higher level offers):

Putting it All Together

It is only by doing CPC x (100 /Conversion Rate) that you arrive at your Cost-Per-Action (CPA), which is arguably the most important benchmark. While it required some legwork to arrive at this ultimate benchmark, by breaking down CPA into its components, you are going to have a much more reliable benchmark and you will be able to cut through a lot of the nonsense data out there.

For example, let’s say that you have an offer in the ‘High-Lift’ category (e.g. a B2B SaaS product that is $500 / month). You do some research using the various forecasting tools in your ad platforms, and find that this is a very competitive space with average CPCs of $25. You also know that your product is likely going to have a conversion rate of around 1% on average, although it could certainly be lower. This results in an expected CPA of $2,500 ($25 * (100 / 1%)). Armed with this data, if you see something online suggesting that B2B SaaS companies “have CPAs usually around $200”, you can skip over it without second guessing yourself.

One final pointer: if your landing page is making an offer in the ‘Medium-to-High’ or ‘High’ lift categories, I would highly suggest experimenting with some different types of funnels to see which produces the highest revenue. For example, instead of pushing for the sale directly on the landing page, have them fill out a short form and then talk to a sales rep, who will attempt to close them over the phone. Alternatively, you could ask for their email and then enter them in an email drip campaign, offer value in each message, and then nudge them near the end of the sequence to buy. A good rule of thumb: if your landing page conversion rate is consistently under 3%, try a lower lift offer and see if it produces a better end outcome.

Conclusion

Hopefully, after reading this article, you now have a much clearer understanding of why most online advertising metrics are BS as well as how to get more reliable metrics. Now is the time to start taking action to get better and more trustworthy data so that you can start to make better decisions for your business and scale your online advertising to the moon.

Good insight