Moats: How to Build a Scalable Business Competitors Can't Copy

11 moats along with historical examples

In business, a moat is a key competitive advantage that is difficult to mimic or duplicate and sets a company apart from its competitors. The term was popularized by Warren Buffet, and is predicated on the idea that just as medieval castles had moats that protected the fortress from invaders, a strong business moat serves as an effective barrier against competition from other firms. As a result, it enables a business to generate large returns over an extended period of time.

While many MBA grads or business owners could rattle off the definition of moat, I have found that many struggle to conceptualize what a strong moat looks like in practice. In this article, I will be describing the various types of moats that exist along with historical examples of companies who successfully leveraged each moat.

Network Moats

A product has a network effect when its value to its users increases in proportion to its use and number of users. The network that most readily comes to mind for most people is a social network, such as Meta, Instagram, or X. However, many other types of products and businesses benefit from network effects as well. For example, the telephone, Peloton, AirBnB, Xbox Live, and more. There are three primary types of network moats:

Moat #1: Marketplace Network (e.g. Uber)

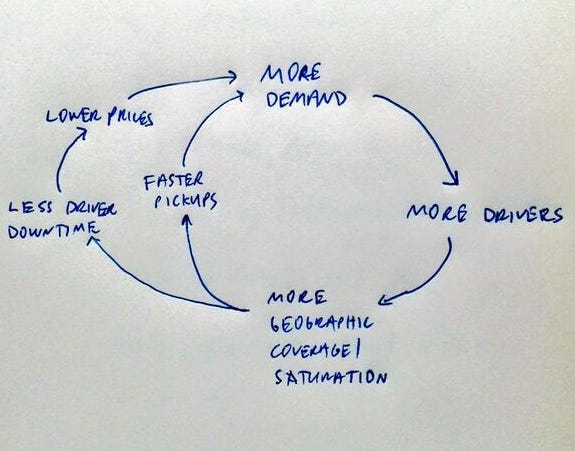

A marketplace network effect exists when a company derives a durable competitive advantage from bringing together customers and suppliers in some kind of marketplace. If this is done effectively, it results in a flywheel in which suppliers are initially brought on to a marketplace, which attracts customers, which attracts more suppliers offering lower prices, which attracts even more customers, which causes the marketplace to grow and become more profitable, enabling it to offer even better terms to suppliers and a better experience for all users.

Uber is an example of a company that has been very successful at building a marketplace network. Uber initially attracted drivers to the platform by offering them on-demand customers and flexible hours. For many drivers, who had periods of large windows of down time with no rides, this was a godsend. At the same time, Uber attracted users by providing them with a guaranteed driver. Prior to Uber, during busy hours, days with bad weather, or if someone was in a remote location, hailing a cab was tricky.

With every driver Uber added to the platform, the geographic reach of the app expanded. This resulted in a shorter wait times for each ride for Uber users. Shorter wait times helped attract additional users, which then led to a further increase in drivers, which meant even greater geographic reach and less time required to find a ride.

A key part of Uber’s strategy from the get go was discounts and promotions to attract its initial set of drivers and customers. This was largely enabled by Uber’s large VC funding, which was close to $2 billion by mid-2014, which enabled it to operate at a loss until it successfully drove out its competition.

Moat #2: Data Network (e.g. Google)

A data network effect exists when a company can gain a competitive advantage by gathering user data and making that data more valuable. The more people who add to this repository, the more useful it becomes. Companies can use that data to attract new users to the platform and to build better algorithms to provide a better product.

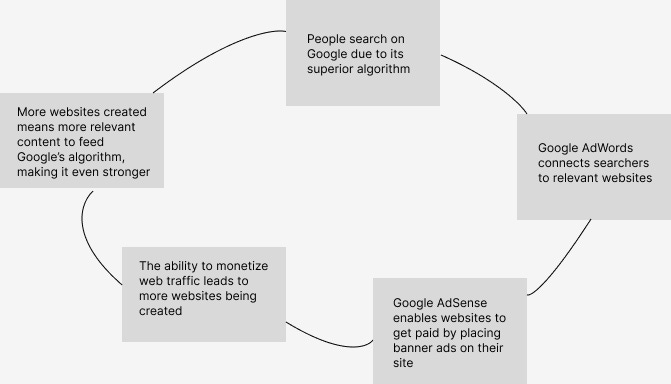

One of the best examples of a data network is Google. Google gained a foothold in the market with a single innovation: better web search. Prior to Google, the previous search ranking algorithms prioritized sites containing certain keywords. Google’s Page Rank algorithm changed the game, by assessing a site’s relevance based on the number of times it had been linked to from other websites. Today, it is estimated that over 8 billion searches take place on Google every day, making it the most popular website in the world.

Google’s dominance in search and the advantage it has gotten from creating a robust data network cannot be under-estimated. It has created a flywheel for Google that has enabled it to expand and dominate over markets. A good outline of Google’s early flywheel was as follows:

This does not even begin to scratch the surface on the massive amounts of data that Google gets from Android phones, Gmail, YouTube searches, Google Shopping, and more.

Moat #3: Platform Network (e.g. Apple)

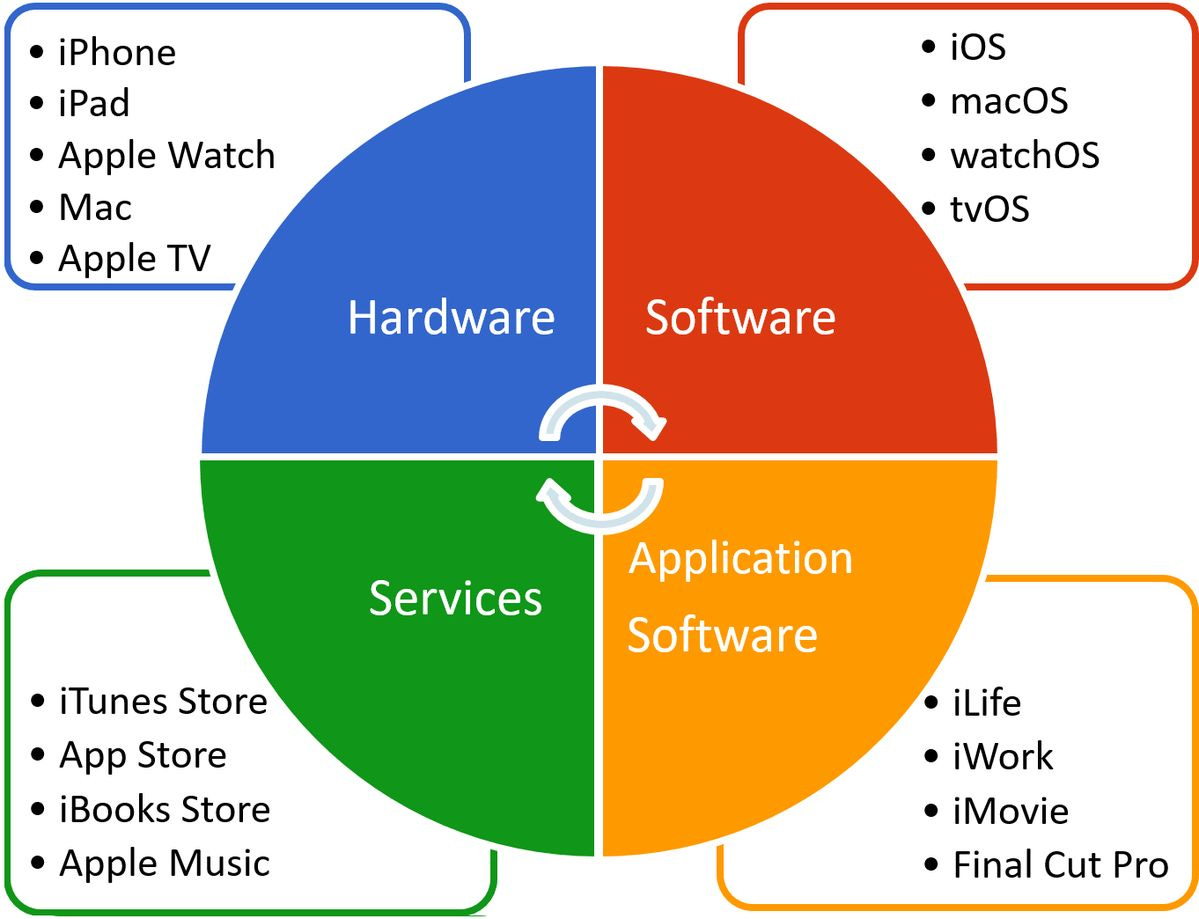

A platform network effect exists when a company builds a durable competitive advantage by keeping its users engaged in its product ecosystem. Platform moats are generally built on one product that becomes core to a user’s life or work. New products that are released both reinforce the core product’s initial value and layer more value on top of it. Each successful new product makes staying in the ecosystem more valuable, increases the cost of switching, and keeps users’ attention and money within the platform.

One of the best examples of a company that successfully established a platform network was Apple. While the Macbook had tremendous sales, it was the layering on of additional products and services that created its stickiness. First, Apple introduced iTunes, which became the de facto standard for digital music and hooked users, as music bought on iTunes could not be exported to other music players. The iPod, a portable music player was next, giving you access to the coolest portable music player on the market. The iPhone and Apple’s iOS software was Apple’s breakout success, giving you the power of a phone, computer, and portable music player all in your pocket. From there, Apple continued to stack products and features into their ecosystem, including the App Store, iPad, AirPods, The Apple Watch, AppleTV, and then iCloud, Airplay, and Airdrop to serve as the glue connecting all of these devices together.

By creating such an interconnected ecosystem, Apple has embedded themselves deeply into the daily lives of their users. The simplicity and uniformity of their product design and the familiar ping when an Apple Device turns on make quitting the Apple ecosystem feel more daunting than kicking a smoking addiction.

Cost Moats

Many of the biggest and most durable business moats in history have been built on an advantage related to cost. Cost moats can take many forms, ranging from high switching costs, to getting users to make a large upfront cost, to having superior operations and producing a super cost advantage. Diving deeper into the three types of cost moats:

Moat #4: Switching Cost (e.g. Slack)

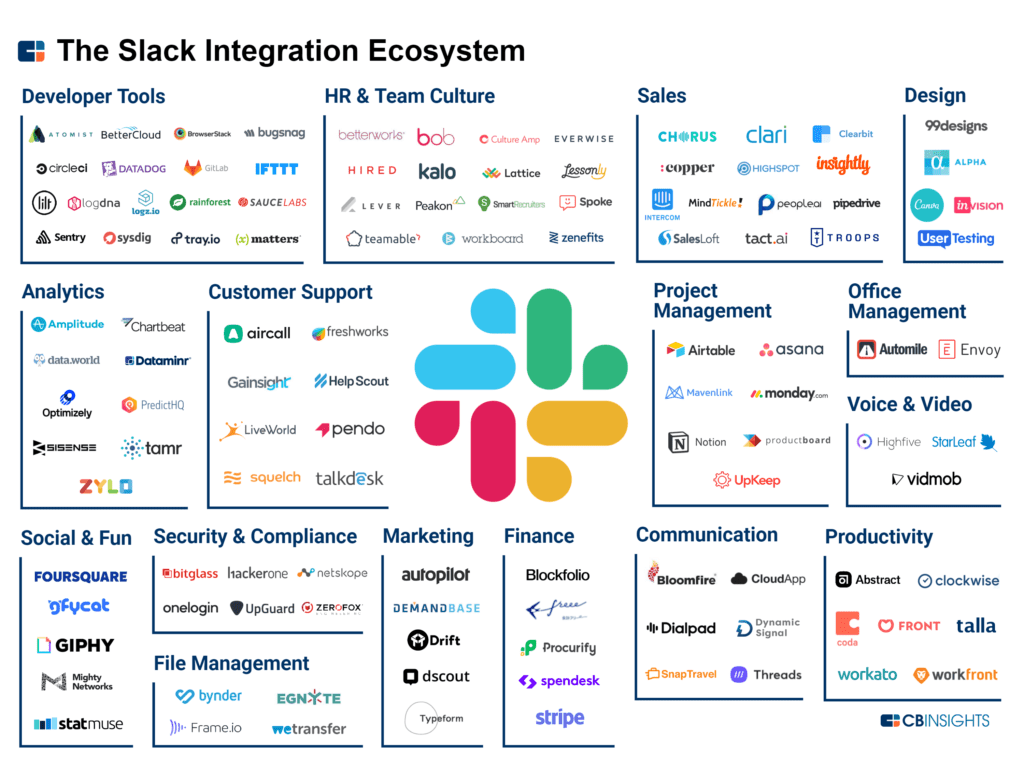

Slack has done a fantastic job of becoming deeply ingrained in the day-to-day habits of their customers. Companies rely on Slack for daily communications, project management, to engage external customers and suppliers, and more. Slack is also in the process of building an ecosystem of apps to increase the product’s stickiness, and they currently have 2,400 apps in their directory and over 1 million active developers.

In addition, Slack has integrations with other popular business tools, such as Google Drive, Salesforce, Zendesk, AWS. They also have created Slack Connect, which allows users to collaborate with external organizations through Slack. This may include supply chain partners, investors, corporate subsidiaries, and more.

By creating a tightly woven ecosystem that entangles users like a spider’s web, Slack makes it incredibly painful to switch. Losing access to previous chat histories is frustrating. Having to train the team and build institutional habits around a new tool is a real headache and very time consuming. Moving over all of your Slack Connect partners to a new system is also draining. As a result of Slack’s strong product and high switching cost, a 2019 study showed that only 10% of Slack users churn in the first year and over 80% of users will stay with Slack for at least 5 years.

Moat #5: Sunk Cost (e.g. Gillette)

In psychology, it is well-known that humans are highly susceptible to what is known as ‘The Sunk Cost Fallacy’. What this means is that we are likely to continue an endeavor if we have already invested in it, whether it be a monetary investment or the effort we put into the decision.

For example, imagine you paid $70 for a concert ticket three months back. The day the concert arrives, you are feeling sick, there is a blizzard, and half of your friend group has opted out. Acting totally rationally, you would ignore the $70 investment, and weigh the pros versus cons of going versus staying home. In reality, the vast majority of people will still attend the concert, feeling compelled to ‘get their money’s worth’.

One company that does a fantastic job of exploiting this tendency is Gillette. Gillette pioneered what has become known as ‘the razor blade business model’, which involves selling a low margin product priced affordably enough to attract wide swaths of people, then a high-margin product to create healthy profits. Gillette has been able to build a $57 billion company by hooking users with its low priced razors and then making serious profit with its high margin replacement blades.

Moat #6: Cost Advantage

Walmart is a retail powerhouse. With over $600 billion in revenue, it is also the world’s largest company by revenue. It is easy to assume that Walmart’s dominance was a foregone conclusion, but it actually had a humble beginning in Bentonville, Arkansas, where Sam Walton opened the first Walmart store in 1962.

When Walmart was coming up, it was the figurative ‘David’, competing against the ‘Goliath’ that was K-Mart. K-Mart’s guiding philosophy was de-centralization, and it allowed individual store owners to have a lot of autonomy. Each store owner was given the authority to pick their own vendors, choose their own products, and set their own prices.

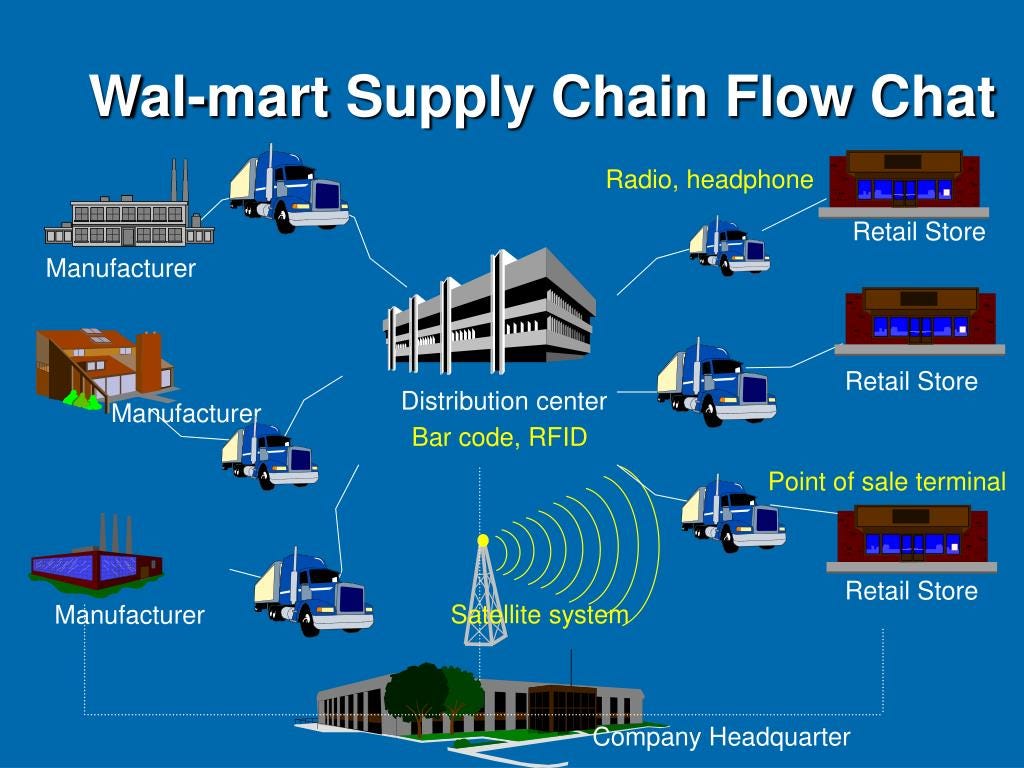

Walmart took the polar opposite approach, integrating each store into a wider logistics, computing, and supply chain network. Coordinated buying across the entire network meant that Walmart was able to gain tremendous negotiating power with suppliers and offer rock bottom prices to customers. Insights from across the entire Walmart network were captured into a centralized system, providing information on what products were popular and simplifying inventory management. A coordinated logistics and warehousing system also meant huge savings on shipping costs and the ability to restock items quickly. Walmart was so successful with its strategy that K-Mart ultimately folded, filing for Chapter 11 bankruptcy in 2002.

Cultural Moats

While many moats are built on hard factors, like data, technology, or partnership agreements, some companies have built enduring businesses as a result of softer cultural moats. These types of moats tend to take a lot longer to develop and are much harder to plan for, but they can be enormously powerful when done well. Two types of cultural moats are most common:

Moat #7: Brand-Based (e.g. Patagonia)

Of all the moats on this list, brand-based boats are probably the most easily recognizable to the average person. Coca-Cola. Disney. Apple. Tesla. Polo Ralph Lauren. All of these companies have carved out a rabid fanbase who are absolutely hooked.

One company in particular has done a fantastic job of building a rock solid brand by radically embracing its core values: Patagonia. Patagonia’s founder, Yvon Chouinard, is an avid rock climber who cares deeply about the environment. Environmentalism is so core to Patagonia’s mission, that they donate 1% of all gross sales to environmental groups.

Some decisions Patagonia has made are head scratchers for your average CEO, but helped prove that Patagonia was a bona fide that put their money where their mouth was. For Black Friday 2011, Patagonia launched a campaign called ‘Don’t Buy This Jacket’, where they encouraged their audience to ‘reduce, repair, re-use, and recycle’ existing Patagonia jackets. Patagonia’s Black Friday sales that year rose 42% as a result.

Another momentous decision occurred in 2019, when Patagonia ended its custom manufacturing and sales of vests to finance companies. Despite the fact that finance culture had embraced Patagonia vests as a uniform of sorts, Patagonia ultimately decided that their values were not aligned with the world of finance and consequently cut the cord.

Moat #8 - Tradition Based (e.g. Marmite)

There is a saying in marketing that goes, “Talk bad about me, talk nice about me, but please talk about me”. This saying might as well have been written for Marmite, whose slogan is “Love it or hate it”. Outside of the UK (and perhaps some former British colonies like Australia, New Zealand, and South Africa) Marmite does not have large brand recognition, but in its country of origin, it is a staple that has a deep significance to the culture.

Marmite is a food spread made from yeast that is a good source of vitamin B, thiamin, riboflavin, and folic acid. Given its nutritional value, and the fact that it does not need to be refrigerated and has a long shelf life, it became a standard military ration designed to combat nutritional deficiencies during WW1 and WW2.

While a good deal of time has passed since the world wars, the product remains an iconic British food that is still sold in its iconic jar, which features a French ‘marmite’ or casserole dish.

Resource Moats

Some of the biggest companies in the world have built huge businesses through the use of resource moats. These include things like copyrights, patents, or legal protections, and are some of the most durable moats when done properly. There are three types of resource moats we will cover:

Moat #9 - Intellectual Property (e.g. Disney)

Many people think of Disney as a family friendly brand that has created classics such as The Little Mermaid, Snow White, and The Lion King. But, beneath the veneer, Disney has been a shrewd operator when it comes to acquiring and exploiting valuable IP.

Over the last several decades, Disney has spent billions purchasing companies for their IP, including Lucasfilm, Pixar, ESPN, and Fox. Disney has also been aggressive about lobbying in order to protect its IP and ensure that its copyrights do not expire. For example, based on the copyright laws that existed when Mickey Mouse was first created, it should have become available for free use in 1984. However, through successful lobbying, Disney was able to extend the copyright protection until 2003 and then once again to 2024 (and without a doubt, they will find a way to extend it again). This means that no other company is able to use the image and likeness of Mickey Mouse without facing a lawsuit. It also means that Disney is able to extract maximum value from this copyright, as well as other spin-offs, remakes, and sequels based on existing IP.

Moat #10 - Regulatory (e.g. Coinbase)

In its infancy, the cryptocurrency space paralleled the wild west, with few rules or regulations and an ‘anything goes’ mentality. As the industry moves closer to maturity, formal procedures are being put in place, and one of the first companies in the space to court regulators and compliance authorities was Coinbase.

Coinbase is one of the few cryptocurrency operators to be awarded a BitLicense from the New York Department of Financial Services. This authorization, granted in 2017, enables Coinbase to run its virtual currency service in the state of New York. This, and other licenses that Coinbase has acquired, require a tremendous amount of money, paperwork, and legal assistance, that are sure to deter many competitors from attempting to follow suit.

Moat #11 - Knowledge (e.g. Renaissance Capital)

Out of all the moats listed in this article, the knowledge moat is easily the least sturdy. Many forms of knowledge can be easily imitated by competitors, for example, by poaching key talent or by copying visible parts of your strategy.

However, Renaissance Capital is a firm that has remained dominant for over 30 years due to its proprietary trading algorithms as well as the brilliance and innovativeness of its founder, Jim Simons. Renaissance’s crown jewel, The Medallion Fund, has grossed over 66.1% average annual return since 1988, netting investors 39.1% average annual returns after management fees.

Simons came from a background in math and cryptography, and had a math degree from IT and a math PHD from Berkeley. He worked as a math professor at Harvard and MIT, and was also a codebreaker for the NSA, before ultimately starting Renaissance Capital at age 40 with the idea of creating a hedge fund focused on algorithmic investing. By putting together a rockstar team of mathematicians, scientists, and engineers, Renaissance was able to find patterns and anomalies in the markets that produced outsized returns relative to its peers.

While there has always been speculation about Renaissance’s secret sauce, the knowledge that makes them so successful has remained largely shrouded in mystery.

Conclusion

In this article, we touched on the key types of business moats, including network moats, cost moats, cultural moats, and resource moats. In the next article, I will be covering some practical advice for startups or SMBs to build their own moats and gain an edge on the competition.

I have also created a cheatsheet which covers all of the moats listed in this article as well as key considerations for each. To get access it, please subscribe to this blog and then email me at jmcritelli6@mail.com with the headline, “Moat Cheat Sheet”.

Kai - I think that it depends on the AI company in question. I think there are different moats each could attempt to build instead of all AI companies falling under a single moat. Some examples:

-Marketplaces often leverage AI (e.g. Amazon's recommendation engine).

-Many companies with vast amounts of data, such as Google and Facebook, are using that data advantage to create their own AI solutions. Solid examples of a Data Network.

-Some companies do a good job of integrating into their customer's workflows / processes and leveraging AI to assist with this; Clay is a good example. As a result, they have a Switching Cost Moat and as they add more and more features, potentially a Platform Network as well.

-Some AI companies like OpenAI with Chat-GPT have established incredibly strong Brand Moats.

-I expect that over time, as regulation around AI increases, we will see more Regulatory Moats and IP Moats in the AI space.

I wouldn't say Knowledge Moats are that robust in AI. Some companies are trying to build an edge by being better at prompting or working with existing AI models, but the underlying models are changing so fast that it's hard to have a lasting edge just from knowledge.

Great article :) Curious - where would some AI companies fit? Would they be in the "data moat" category or "knowledge moat"?